In addition to these choices, they can utilize a modified version of each and "mix" the programs, if you will. For instance, a borrower born in 1951 who owns outright a $385,000 home may choose it is time to get a reverse mortgage. Why? The borrower desires $50,000 at near to make some changes to the residential or commercial property and to fund a college strategy for her grandchild - why do mortgage companies sell mortgages.

She can take a modified term loan with a $50,000 draw at closing and set up the regular monthly payment for four years of $1,000 per month. That would leave her an extra $107,000 in a line of credit that she would have offered to use as she pleases. If she does not utilize the line, she does not accrue interest on any funds she does not use and the on the unused portion.

Let us look at the $200,000 credit line revealed above. As we went over, numerous individuals utilized to think about the reverse home loan a last hope. However let us consider another customer who is a savvy coordinator and is preparing for her future requirements. She has the earnings for her existing needs but is worried that she might require more money later on.

Her credit line grows at the same rate on the unused part of the line as what would have accrued in interest and had she borrowed the cash. As the years go by, her line of credit boosts, suggesting if she one day requires more funds than she does now, they will be there for her.

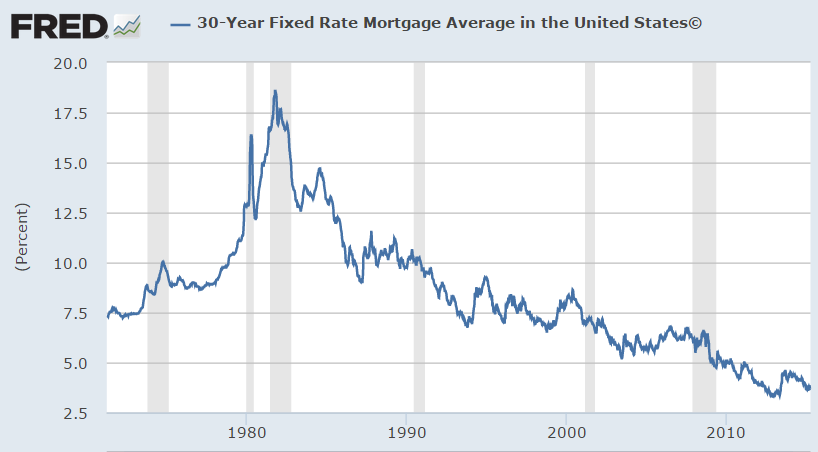

If rate of interest go up 1% in the third year and another percent in the 7th, after twenty years her offered credit line would be more than $820,000. when did 30 year mortgages start. Now of course this is not earnings, and if you do borrow the money you owe it and it will accrue interest.

But where else can you make sure that you will have in between $660,000 and $800,000 available to you in twenty years? The calculator is shown listed below, and you can see the very modest rate boosts utilized. If the accrual rates increase more the development rate will be greater. The needs you to take a lump amount draw.

Things about How Do Reverse Mortgages Really Work

You can not leave any funds in the loan for future draws as there are no future draws permitted with the repaired rate. The reason for this is because of the development of the line. As you can see the growth rate can be rather considerable and if there were numerous debtors with yet unused funds who obtained at low repaired rates however desired to finally access their funds years later on after rates had actually increased, debtors would have substantially higher funds readily available to them at rates that were not offered and may not be able to cover the need of listed below market ask for funds.

Since debtors experienced a much higher default rate on taxes and insurance when 100% of the funds were taken at the initial draw, HUD changed the approach by which the funds would be available to customers which no longer enables all debtors access to 100% of the Principal Limit at the close of the loan.

HUD calls these essential benefits "compulsory commitments. You have access to as much as 100% of their Principal Limit if you are utilizing the funds to purchase a home or to pay compulsory obligations in combination with the transaction. You can likewise consist of approximately 10% of the Principal Limitation in money (approximately the maximum Principal Limitation) above and beyond the necessary commitments if needed so that you can still get some money at closing.

If you have a $100,000 Principal Limit and no loans or liens on your home, you can take up to 60% or $60,000 of your profits at closing or whenever in the very first 12 months of the loan. You can access the remaining $40,000 at any time. This is where the repaired rate loan starts to impact customers one of the most.

In other words, per our example, as a set rate debtor you would get the $60,000, but due to the fact that the repaired rate is a single draw there would be no additional access to funds. You would not, for that reason, be able to get the extra $40,000 and would surrender those funds. If you were utilizing the whole $100,000 to pay off an existing loan, either program would work equally well because all the cash would be required to settle the obligatory responsibility (indicating the existing loan) which HUD enables.

Specifically if you have a loan that you are settling. There is often room in the worth of the loan for the lender to make back cash they invest in your behalf when they sell the loan. Lending institution credits are allowed by HUD - what is the current interest rate for mortgages?. Look around and see what is readily available. what is wrong with reverse mortgages.

All About How Many Mortgages Are There In The Us

A very low margin will accumulate the least quantity of interest when you start using the line, but if you are trying to find the biggest amount of line of credit development, a greater margin grows at a greater rate. Getting the least quantity of costs on your loan won't assist you if you plan to be in your house for 20 years, because because twenty years the interest will cost you 10s of thousands of dollars more, therefore ruining your goal to preserve equity.

I informed you that we do not suggest reverse home mortgages for everybody. If a reverse home loan does not fulfill your requirements and you are still going to be scraping to manage, you will require to deal with that fact before you begin to utilize your equity. If the will approach the amount you will get from the loan, because you live in an area where closing expenses are very high, and your residential or commercial property value is less than $40,000, you need to concentrate about whether you want to use your equity on such an endeavor.

The reverse home http://www.wesleyfinancialgroup.com/ loan is supposed to be the last loan you will ever need. If you understand you are not in your forever home, think about utilizing your reverse home mortgage to purchase the best house rather of utilizing it as a short-lived solution one that is not a true solution at all.

You require to understand how these loans work, what your strategies are, and which choices will best achieve your goals (what is required https://www.globenewswire.com/news-release/2020/04/23/2021107/0/en/WESLEY-FINANCIAL-GROUP-REAP-AWARDS-FOR-WORKPLACE-EXCELLENCE.html down payment on mortgages). Education is the key and do not hesitate to compare. If you did not previously, ideally you now know how they work and are on your way to determining if a reverse home loan is best for you.

Reverse home loan primary limit factors are based upon actuarial tables. On average a 62-year-old will get approximately 50% of the homes assessed worth, where an 80-year-old will get closer to 70%. Reverse home loans are not inherently great nor bad. The choice to take a reverse home loan must always be looked at as a private approach weighing long-lasting suitability.