In real estate, the loan margin is typically reviewed in terms of basis points, which is the margin portion increased by 100. For instance, a property specialist would likely refer to a 3% margin as 300 basis factors above the benchmark. Remember, the rate of interest can climb or fall, which will cause a higher or lower home loan settlement to cover in your budget. Adhering car loans are mortgages that fulfill details standards that enable them to be offered to Fannie Mae and Freddie Mac. Lenders can sell home loans that they come from to these government-sponsored entities for best timeshare cancellation company repackaging on the additional mortgage market if they conform to their rules.

- The bottom line for flexible price home mortgages is to be cautious what you sign up for.

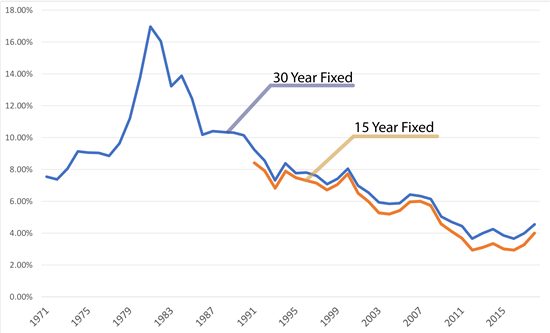

- With prices still unusually low by historic criteria, those that expect possessing their residence for 10 or more years will likely profit by securing today's prices for the long run.

- Fortunately, putting in the time to recognize how ARMs function can aid you be prepared in situation your price increases.

- Ask your lending institution if there is a possibility of unfavorable amortization in your financing.

The choice of a house mortgage lending is complicated as well as time consuming. As a help to the customer, the Federal Reserve Board as well as the Federal Mortgage Financial institution Board have prepared a home mortgage list. Some arrangements may require the purchaser to pay unique charges or charges if the ARM is paid off early. As of April 5, the nationwide average 30-year set home loan is 4.8%. Real-time last sale information for U.S. stock quotes reflect trades reported through Nasdaq just. Intraday information postponed at the very least 15 mins or per exchange requirements.

How Does Mortgage Rate Of Interest Job?

These lending institutions are transforming instead to a rate called the Secured Overnight Financing Price, or SOFR, which is intended to be a lot more resistant to control. "I had not really considered the quantity of flexibility it offers you to have ... control over possibly lowering your price," says Hunsaker. She is the CEO of AskFlossie.com, an on-line monetary area for females. While lots of professionals say ARMs aren't a good deal for the majority of property owners who prepare to stay in their house for decades, they do use some advantages. The scenario described in the paragraph over is called a carryover as well as it is one http://kylerldiz493.jigsy.com/entries/general/what-is-a-mortgage-basics-for-first of the lots of conditions of ARMs that are missed or misinterpreted by consumers.

Rocket Home Mortgage

Investopedia calls for writers to use key resources to sustain their job. These include white documents, federal government information, original coverage, and meetings with market experts. We also reference original study from other credible publishers where appropriate. You can find out more concerning the requirements we follow in creating accurate, unbiased content in oureditorial policy. Register NowGet this delivered to your inbox, as well as more details about our services and products.

Types

They normally give customers five to ten years before prices adjust for the very first time. That longer time horizon offers property owners a bigger home window of chance to develop equity, which would certainly make it much easier to refinance or offer the home without owing more on the exceptional mortgage than the residential property deserves. Today's variable-rate mortgages likewise have reduced restrictions on the number of rate changes that can take place, with caps on each specific modification, as well as for the life of the loan. Adjustable-rate mortgages obtained a negative name in the real estate bubble because they were hung at some customers that could not get a traditional mortgage. Considering that the initial "teaser" price indicated that those purchasers' regular monthly payments were reduced, lending institutions were a lot more ready to push with the Home page lendings, according to research study from Brookings Organization. So keeping a close eye on those change caps is critical when getting a variable-rate car loan.

Understand, though, that the longer the set duration for your ARM, the higher the rate of interest. If you're developing yourself in a career, if you're single as well as/ or childless, or if you just have an attention deficit disorder, an ARM with the most affordable rate-- the 3/1 or 5/1-- most likely makes a great deal of feeling. You'll conserve a lot of cash in rate of interest while you own your residence, and you're most likely to be long gone by the time the financing starts changing. Take into consideration additionally that this was not long after the housing crisis, when home owners discovered they couldn't count on being able to market their homes within a couple of years of purchasing. That is, while the low, introductory price for the ARM home loan was still effectively.

A variable-rate mortgage is a home loan with a variable rate of interest that's connected to a specific standard. A home loan is a funding commonly used to buy a residence or other item of realty, for which that residential or commercial property then works as security. " For a variable-rate mortgage, what are the index as well as margin, and also how do they work? Take a borrower that is purchasing one residence and offering one more one at the exact same time. That individual might be required to buy the brand-new residence while the old one is in agreement and also, consequently, will certainly secure a one- or two-year ARM. When the debtor has the proceeds from the sale, they can reverse to pay off the ARM with the proceeds from the residence sale.